Since the release of OpenAI’s ChatGPT in November 2022, the chatbot has gone on to become one of the fastest-growing consumer applications ever launched, paving the way for a new era of generative AI adoption.

Venture capital firm a16z has published a blog post detailing how consumers are utilising generative AI products. By using traffic data from SimilarWeb, the VC firm analysed data from the top 50 GenAI web products by monthly visits to not only see how the products have grown but also know where the growth comes from.

A16z compared the web traffic and app traffic to choose the companies for its report. The ranking is a tool to identify and understand category trends but is not an overall ranking of consumer AI platforms. In its report, A16z came away with six main takeaways.

1. Many of the most popular products today are built on generative AI

A16z’s findings show that many of the products on the list didn’t exist a year ago. In fact, 80% of the websites were created less than a year ago. So while many established companies are adding AI to their products, many of the most innovative consumer experiences are completely new.

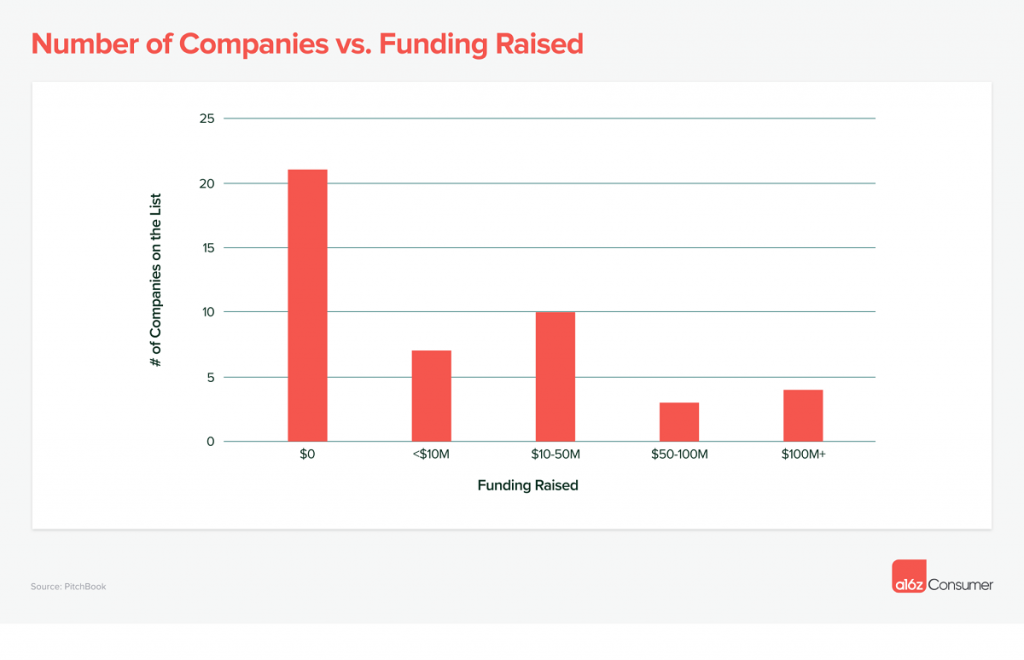

Out of the 50 companies on the list, only five are owned or acquired by pre-existing big tech companies: Bard (Google), Poe (Quora), QuillBot (Course Hero), Pixlr (123RF), and Clipchamp (Microsoft). Nearly half (48%) of the remaining companies on the list have not received any outside funding.

2. ChatGPT is currently the leader in generative AI, but other companies are catching up quickly

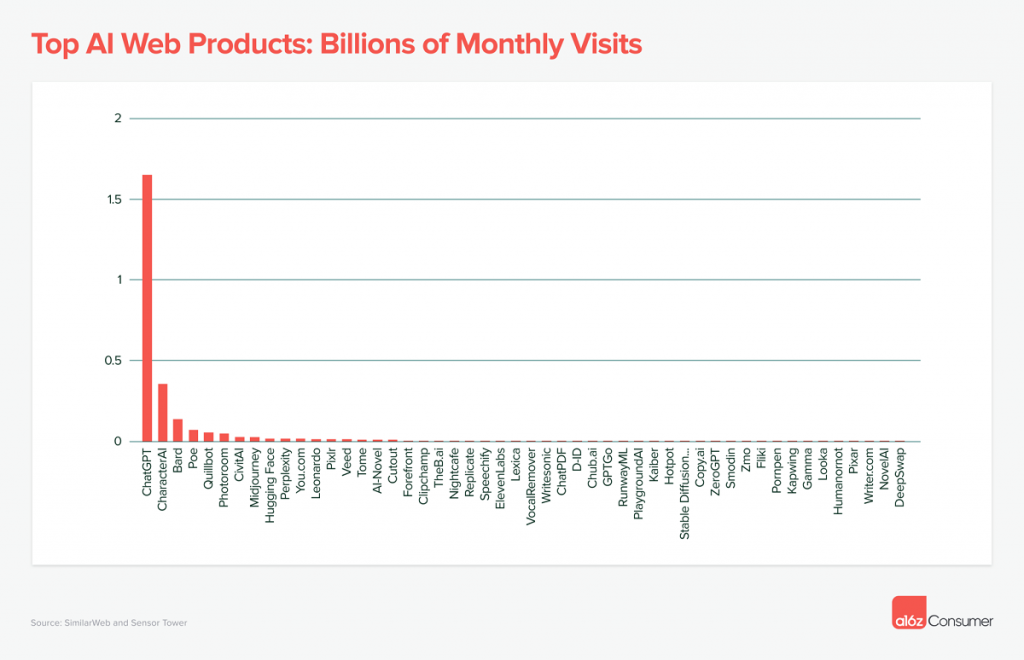

ChatGPT remains the most popular generative AI website, representing 60% of monthly traffic to the top 50 generative AI websites. It has an estimated 1.6 billion monthly visits and 200 million monthly users, making it the 24th most visited website in the world.

According to A16z, hardly any other product has seen such a ramp, but CharacterAI is a close second with about 21% of ChatGPT’s traffic. When combining web and mobile app traffic, ChatGPT ranks about the same scale as Reddit, LinkedIn, and Twitch—but still far behind social giants like WhatsApp, YouTube, and Facebook.

3. LLM assistants like ChatGPT are currently dominating, but there is an emerging trend towards companionship and creative tools

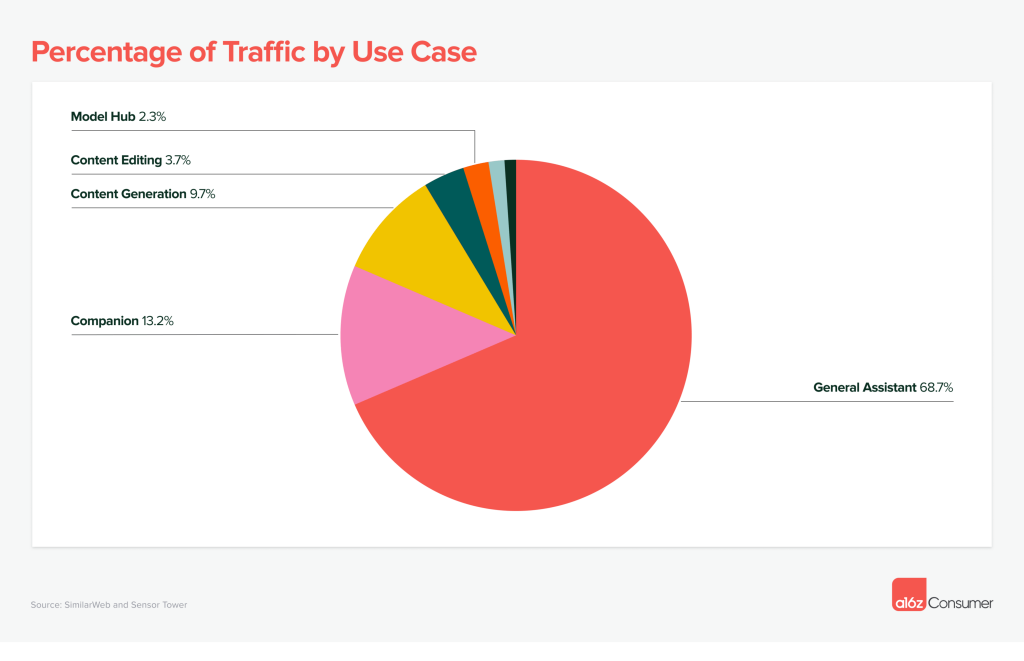

Out of the top 50 list, general LLM chatbots account for 68% of total consumer traffic. This category includes not only ChatGPT but also Google’s Bard and Quora’s Poe, all of which are ranked in the top five.

In the past few months, two other categories, namely AI companions like CharacterAI and content generation tools such as Midjourney and ElevenLabs have gained significant usage and driven an upsurge in their popularity. In the broader category of content generation, the top use case is image generation, accounting for 41% of the total traffic. Following closely behind are prosumer writing tools, making up 26% of the traffic, followed by video generation at 8%.

4. Some companies have already established themselves as leaders in the generative AI market

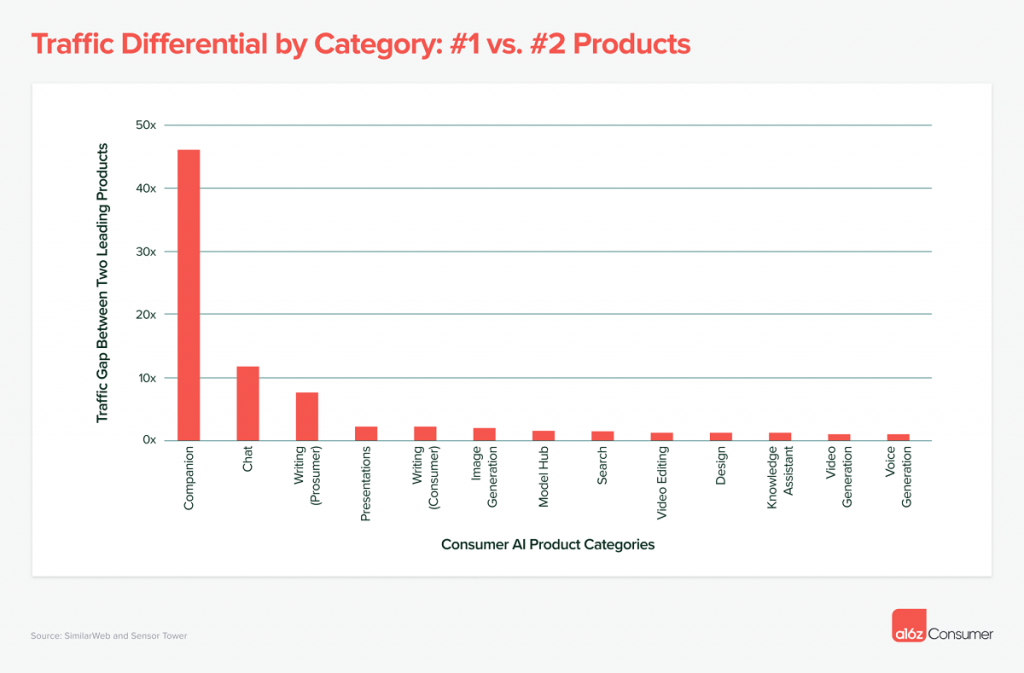

However, developers will be happy to know that there is still plenty of room to succeed with generative AI, even though it is becoming more popular. Most generative AI categories are still competitive, with the top company receiving only twice (or less) the number of visits as its closest competitor, except for companionship.

A16z says that it is also seeing significant fragmentation which suggests that there is room for a variety of successful companies in the generative AI space. Image generation is a good example of fragmentation in the generative AI space, and while Midjourney is the most popular image generation platform, Leonardo, which focuses on gaming assets, is also growing rapidly.

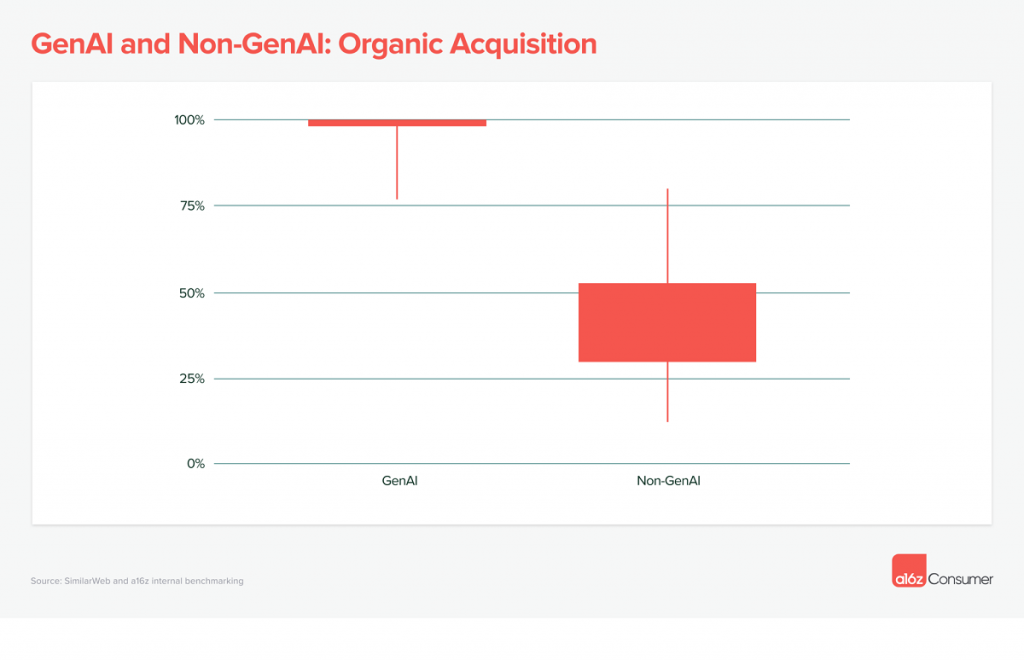

5. Top generative AI products are acquired organically, with eager consumers willing to pay

Many consumer apps have been acquired in the past five years, as it’s been hard to excite users about new products without a platform shift. Acquiring new customers has become more expensive as well, so consumer companies must focus on metrics like lifetime value and customer acquisition cost.

The bottom 25% of generative AI products get only 2% of their traffic from paid sources, compared to 70% for non-AI consumer subscription companies. And consumers are willing to pay for generative AI as 90% of the companies on the list are already monetising with nearly all of them through subscriptions. The average product on the list makes $21 monthly per user or $252 per year.

6. Mobile apps are still a new platform for generative AI but have the potential to become a major player

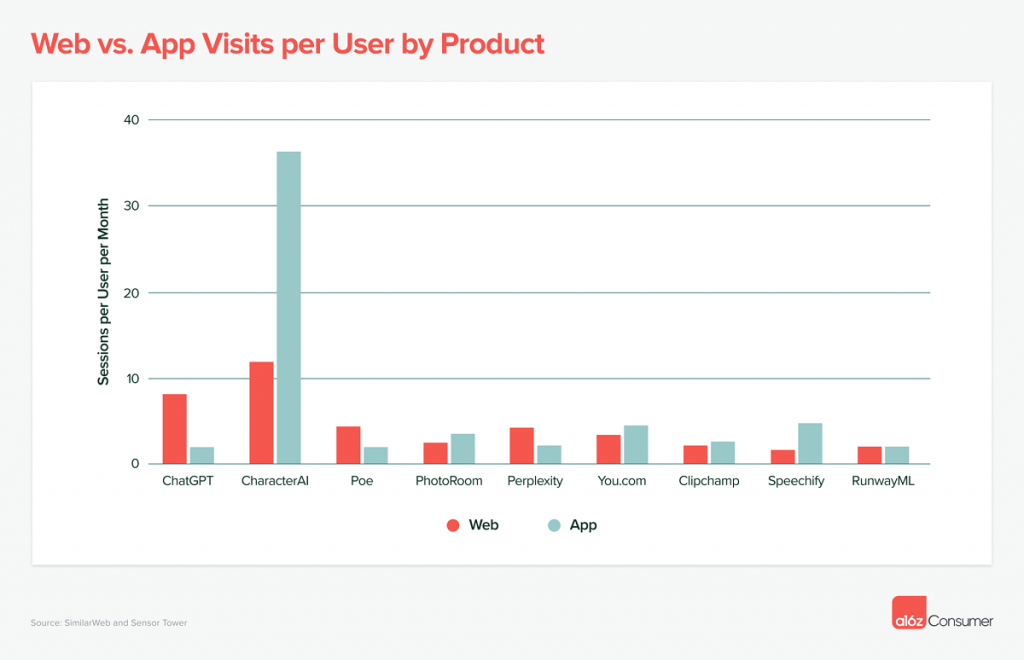

Most consumer AI products have been launched for the web first, rather than as mobile apps. Even ChatGPT didn’t have a mobile app for six months after it launched. Some of the reasons AI companies aren’t building on mobile could be because browsers are a good way to reach a wide range of users.

Also, Many AI companies have small teams and don’t want to spread themselves too thin by developing apps for multiple platforms. Only 15 of the companies on the list have a mobile app and most of their traffic comes from the web, not the app.

We expect to see more mobile-first generative AI products in the future since people now spend more time on their phones than on their computers. Overall, a16z finds that the generative AI market is very exciting and has the potential to revolutionise many industries.

You can read the full blog post here.

Isa Muhammad is a writer and video game journalist covering many aspects of entertainment media including the film industry. He's steadily writing his way to the sharp end of journalism and enjoys staying informed. If he's not reading, playing video games or catching up on his favourite TV series, then he's probably writing about them.