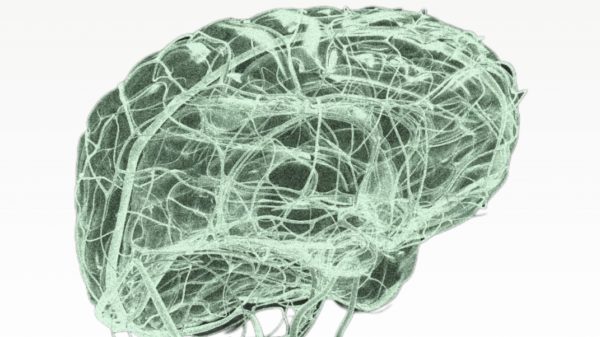

Analyst firm IDC has projected robust growth for virtual reality headsets, but it anticipates even more substantial growth for less elaborate wearables. It expects the latter to significantly surpass the sales of the former for many years to come.

However, before the shipments of VR equipment can experience growth, vendors must confront a challenging year. In the latest findings from analysts, it was revealed that the quantities of augmented reality and virtual reality (AR/VR) headsets declined by 44.6 per cent year-over-year in Q2.

A promising year ahead

According to IDC in a release, “Downward pressure from the global economy has curbed demand while the negative impact of a price hike on the popular Quest 2 headset combined with ageing hardware from multiple vendors to further hobble growth in this market.”

Throughout 2023, the IDC anticipates that approximately 8.5 million headsets will be shipped, which is only slightly higher than the number sold in 2017. The analyst firm also predicts that 2024 will be a more promising year for head-mounted devices, with a significant 46.8 per cent year-over-year growth.

This growth will be fueled by the introduction of new hardware from Meta and ByteDance, along with the debut of Apple’s Vision Pro. Then by 2027, the global market is expected to reach a total of 30.3 million units across the globe.

Wearables to remain dominant

However, this figure falls significantly short of the ‘earwear’ sub-category within the wearables market, which IDC reports is already selling 320 million units annually and is projected to grow to 380 million by 2027.

In the same year, IDC expects shipments of 211.4 million smartwatches, along with 29.4 million smart wristbands. This means that while VR would undoubtedly gain traction and become more popular in 2027, it still wouldn’t become a mainstream headset even after Apple’s Vision Pro has become available.

According to Ramon T. Llamas, research director with IDC’s Wearables team, “Most consumers think of popular brands like Apple, Samsung and Fitbit when it comes to wearables, and they would be correct.

“But driving growth are numerous smaller companies that may not have the global aspirations as the market leaders, but instead focus on specific geographies such as China and India with fully featured devices that meet price expectations.”

The research director concludes by saying that it’s quite conceivable that some of these brands could eventually be spoken of in the same league as the world’s most renowned ones. It’s also possible to envision them expanding into neighbouring markets where there is still an untapped demand waiting to be met.

Isa Muhammad is a writer and video game journalist covering many aspects of entertainment media including the film industry. He's steadily writing his way to the sharp end of journalism and enjoys staying informed. If he's not reading, playing video games or catching up on his favourite TV series, then he's probably writing about them.