Ecommerce giant Amazon has dived into the world of NFTs with its new investment in Dibbs. Details of the investment were not disclosed, but Dibbs raised a $13 million Series A investment in July.

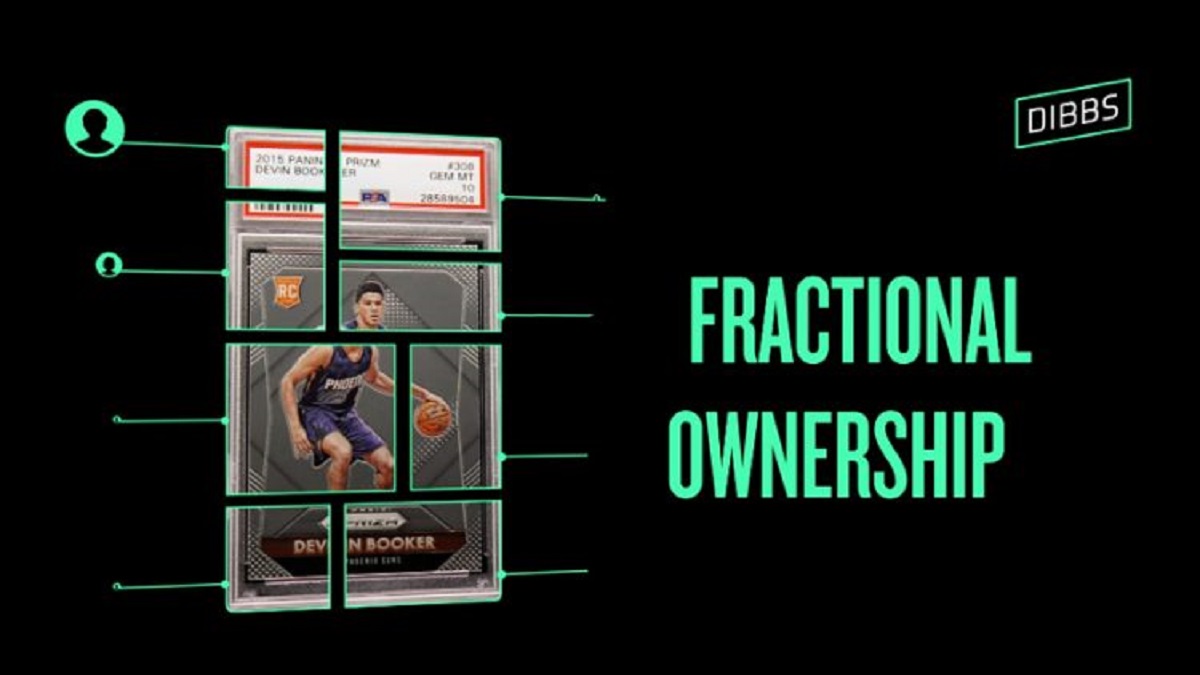

As a digital platform, Dibbs has been focused on bringing NFTs to the broad population with its introduction of fractional investing.

According to Dibbs’ Founder and CEO Evan Vandenberg, a fractional approach helps to lower barriers to entry for most users. “For too long, the collectibles market has been riddled with barriers to entry that render it inaccessible and inequitable… Traditional ownership has limitations that the emerging metaverse eliminates. Moving these collectibles, which genuinely represent an individual’s online persona, into the digital domain is essential for the future of ownership and identity.”

For a long time, a fractional approach to investments has been popular among investors in the mainstream market. From stocks to commodities and more, fractional investment offers the average user the opportunity to own a share of the market, no matter how much money they have to hand.

NFT ownership has landed on the (virtual) shoulders of one owner; meaning that good/bad performance disproportionately fell on them too. But with many assets having price tags in the hundreds of thousands to millions – fractional ownership is a welcome change.

Former editor of - and now contributing writer to - our partner site BlockchainGamer.biz, James is a freelance tech, finance and gaming journalist and expert on the NFT and blockchain space.